Nubank

Description

Introduction to Nubank APK

In the ever-evolving world of digital banking, Nubank has emerged as a trailblazer in Brazil, revolutionizing how people manage their finances. As the most recommended financial organization in Brazil, Nubank boasts over 85 million customers who appreciate its comprehensive approach to financial management. This app offers a seamless experience that integrates various financial services into one platform, making it easier for users to keep track of and resolve their financial lives efficiently.

Founded in 2013, Nubank set out to challenge the traditional banking system, which was often criticized for its high fees, poor customer service, and lack of transparency. By leveraging technology, Nubank aimed to provide a more user-friendly and cost-effective alternative. Over the years, it has grown exponentially, thanks to its innovative approach and customer-centric philosophy.

Core Features in Nubank APK latest version

Nubank’s success can be attributed to its robust set of features designed to meet the diverse needs of its users. Here are some of the core features that make Nubank a standout choice:

- No Fees: Nubank prides itself on offering a fee-free banking experience. There are no maintenance fees, annual fees, or international transaction fees, which is a significant relief for users tired of hidden charges.

- NuConta: This is Nubank’s digital account, which offers high-yield savings, easy transfers, and bill payments. It also provides instant notifications for transactions, helping users keep track of their spending in real-time.

- Nubank Credit Card: The Nubank credit card is a major attraction, offering competitive interest rates, no annual fees, and real-time spending alerts. Users can manage their credit limits and pay their bills directly through the app.

- Personal Loans: Nubank offers personal loans with flexible repayment options and competitive interest rates. The loan application process is quick and can be completed entirely within the app.

- Customer Support: Nubank is known for its excellent customer service, available 24/7 through various channels, including chat, email, and phone. The support team is well-trained and capable of resolving issues promptly.

- Security: The app employs advanced security measures, including biometric authentication and encryption, to ensure that users’ financial data is safe and secure.

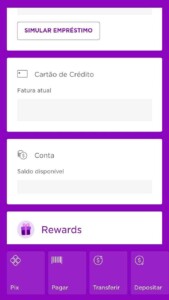

User Interface and User Experience Analysis

One of Nubank’s standout features is its user interface (UI) and user experience (UX). The app is designed with a minimalist aesthetic, focusing on functionality and ease of use. Here’s a closer look at its UI/UX:

- Clean Design: The app’s interface is clean and uncluttered, making navigation intuitive. Users can quickly find what they need without being overwhelmed by options.

- Accessibility: Nubank ensures that its app is accessible to all users, including those with disabilities. Features like voice assistance and easy-to-read text contribute to a more inclusive experience.

- Real-Time Updates: The app provides real-time notifications for all transactions, helping users stay on top of their finances. This transparency builds trust and allows users to monitor their spending closely.

- Customizable Dashboard: Users can customize their dashboard to highlight the features they use most frequently. This personalization enhances the overall user experience by providing quick access to essential functions.

- Seamless Integration: Nubank integrates seamlessly with other financial tools and services, allowing users to manage all their financial activities from one platform.

Comparison with Similar Apps – Free download Nubank APK 2024 for ANdroid

While Nubank is a leader in the digital banking space in Brazil, it faces competition from other apps like PicPay, Banco Inter, and C6 Bank. Here’s how Nubank compares:

- PicPay: PicPay is a popular payment app that offers cashback on purchases and bill payments. However, unlike Nubank, PicPay does not offer a credit card or personal loans, making Nubank a more comprehensive financial solution.

- Banco Inter: Banco Inter is another digital bank that offers a range of services similar to Nubank, including a fee-free account and credit card. However, Nubank’s user interface and customer support are often rated higher.

- C6 Bank: C6 Bank provides similar services but distinguishes itself with additional features like investment options and a loyalty program. While Nubank doesn’t currently offer investment services, its focus on simplicity and user experience keeps it ahead in customer satisfaction.

Summary

Nubank has set a new standard for digital banking in Brazil with its customer-centric approach and innovative features. From no-fee banking to a user-friendly app interface, Nubank addresses the pain points of traditional banking while providing a modern, efficient, and secure financial management solution. Its commitment to transparency, excellent customer support, and continuous improvement has garnered a loyal customer base, making it a top choice for many Brazilians.

FAQs

-

Is Nubank available outside Brazil?

Currently, Nubank primarily operates in Brazil, but it has expanded to Mexico and Colombia.

-

How do I open a Nubank account?

You can open an account by downloading the Nubank app and following the registration process, which includes verifying your identity and providing necessary personal information.

-

Are there any fees associated with Nubank?

Nubank is known for its no-fee policy, meaning there are no annual fees, maintenance fees, or international transaction fees for its services.

-

What happens if I lose my Nubank card?

If you lose your card, you can immediately block it through the app and request a new one.

-

Can I use Nubank for international transactions?

Yes, Nubank cards can be used for international transactions without any additional fees.

In conclusion, Nubank offers a modern, user-friendly banking experience that addresses the shortcomings of traditional banking systems. Its innovative features, combined with excellent customer service and a strong focus on security, make it a preferred choice for millions of users. Whether you are looking to simplify your banking experience or need a reliable financial management tool, Nubank has much to offer.

Images